Our sponsorship comes from a distinguished affiliate of Brookfield Corporation (formerly known as Brookfield Asset Management Inc.), whose asset management business is one of the world’s leading alternative asset managers. Empowered by their global expertise, we manage these business-critical assets with a strong focus on operational excellence, workplace innovation and sustainability, positioning us as the 'landlord of choice' for our tenants.

India plays a vital role in the long-term investment strategy of the Brookfield Group. With a decade-long presence and deep knowledge of the Indian market, combined with substantial global asset management expertise, Brookfield is one of the largest real estate investors in India, with a high-quality office portfolio.

TOTAL ASSETS UNDER MANAGEMENT

REAL ESTATE

INFRASTRUCTURE

RENEWABLE POWER

PRIVATE EQUITY

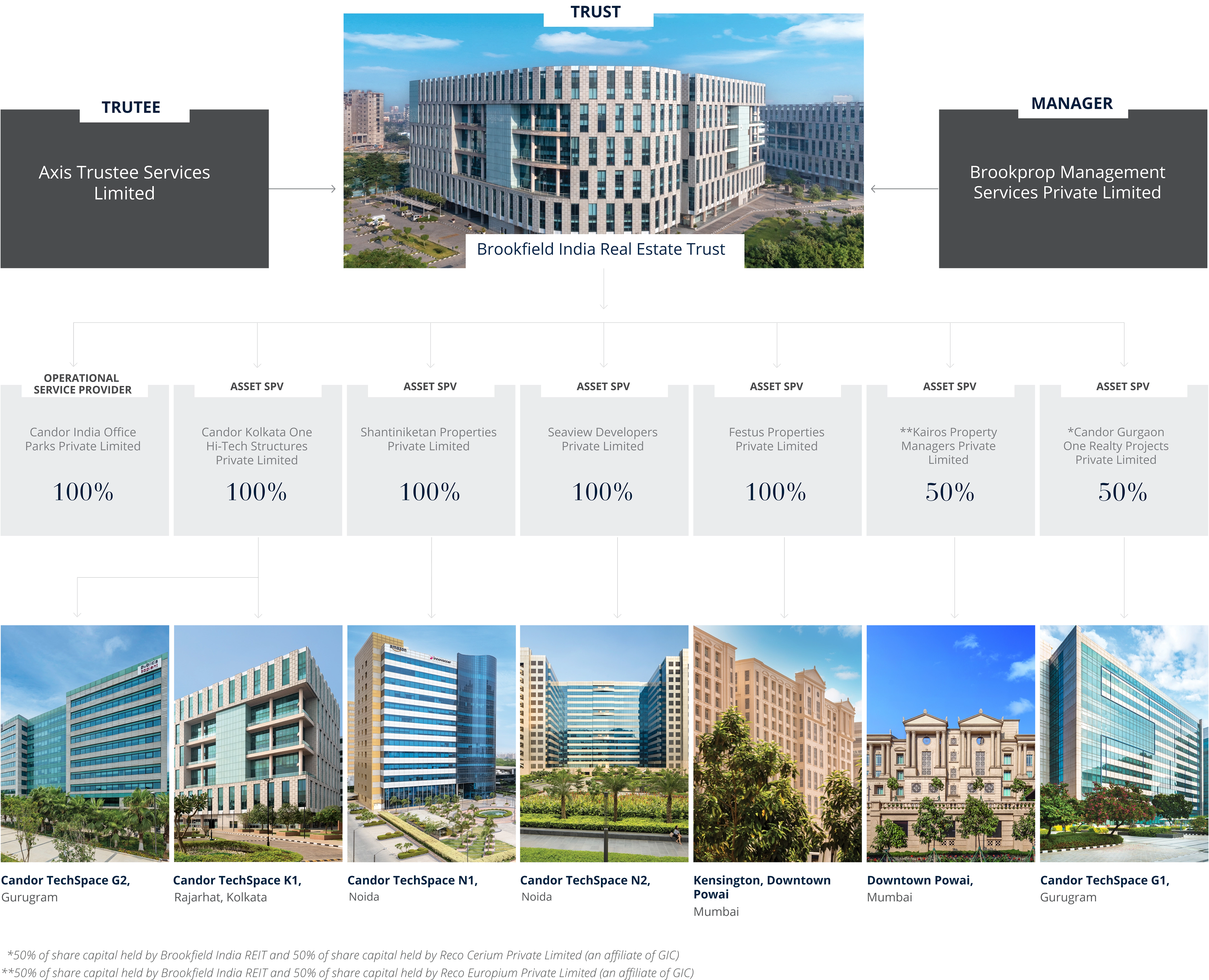

Our Manager, Brookprop Management Services Private Limited is an affiliate of Brookfield Corporation. With an experienced management team, our Manager efficiently oversees development, management, leasing and marketing of our office parks. Its commitment to the REIT portfolio, focused on sustainability, excellence and innovative upgrades at our office parks helps meet our tenants' evolving needs. This makes our office parks an attractive destination, ensuring value accretive growth for all our stakeholders.