Brookfield India REIT is India's only 100% institutionally managed real estate investment trust.

IN-PLACE RENT

PER MONTH

UNIT NAV

MARKET TO MARKET

POTENTIAL

WALE (YEARS)

VALUE FROM

COMPLETED ASSETS

LTV

TOTAL VALUE OF

THE PORTFOLIO

During FY2021, we witnessed a period of unimaginable disruption brought about by the impact of the coronavirus pandemic. Our collective resilience as individuals as well as businesses has been put to test. I am grateful to have seen the level of commitment that our teams showcased to ensure business continuity for us and for our tenants and I am proud that our business and its performance has proven its mettle.

Ankur Gupta Chairman, Board of Directors

Manager of Brookfield India REIT

It gives me immense pleasure to share with you our first annual report , which highlights the resilience of our business in the face of unprecedented challenges. Our strong relationship with our tenants and the value proposition of our properties enabled us to keep our Portfolio stable and strong through these challenging times.

Alok Aggarwal CEO

Manager of Brookfield India Real Estate Trust

Brookfield India REIT’s inherent business model relies on contractual agreements with trustworthy parties. Despite the adversities posed by the pandemic, our underlying business has remained consistent and Brookfield India REIT’s story remains unchanged.

New Leasing (sf) 122,000

Leased and Renewed (sf) 673.000

Average Re-leasing (%) 17%

New Area Delivered (sf) 481,000

Income from Operating Lease Rentals (OLR) 6,100

Revenue from Operations 8,628

Net Operating Income (NOI) 6,600

Comparable NOI 6,548

Brookfield India REIT has a robust portfolio of campuses catering to a diverse tenant base.

KNOW MORE

Powai, Mumbai

Gurugram

Noida

Kolkata

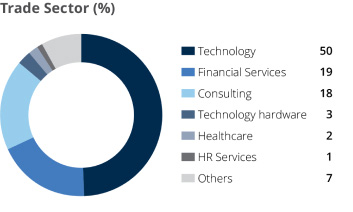

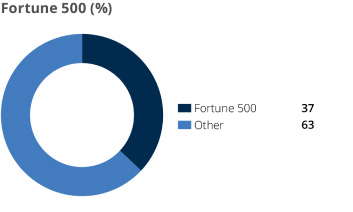

Our tenants are well positioned to take advantage of the favorable regulations and industry opportunities. Brookfield India REIT is providing these corporates with the requisite spaces to optimize their potential.

Brookfield India REIT is fully committed to developing and operating high-quality assets that meet the highest standards of environmental sustainability, enable positive social impact and have an institutional governance mechanism.

We are devoted to providing an experience that is ecologically responsible, pollutionfree and encourages sustainable best practices.

KNOW MORE

Our placemaking philosophy is imbibed in our daily operations and is a crucial aspect of our philosophy.

KNOW MORE

At Brookfield India REIT, we uphold the highest standards of ethics, integrity, transparency and regulatory compliance.

KNOW MORE

Our agile response to the disruptions caused by the pandemic, has helped ensure the smooth continuity of critical operations. Despite the scarcity of labor, we’ve ensured that the developments in our properties are on track.

KNOW MOREIndia’s vast and educated workforce, relatively low rents for high-quality commercial spaces and favorable regulatory developments make it an ideal destination for global corporations to set up shop.